For example an individual who has survived cancer may be considered a substandard risk for health or life insurance policies. It is also known as impaired risk.

Free Life Insurance Quote With Pre Existing Condition

Free Life Insurance Quote With Pre Existing Condition

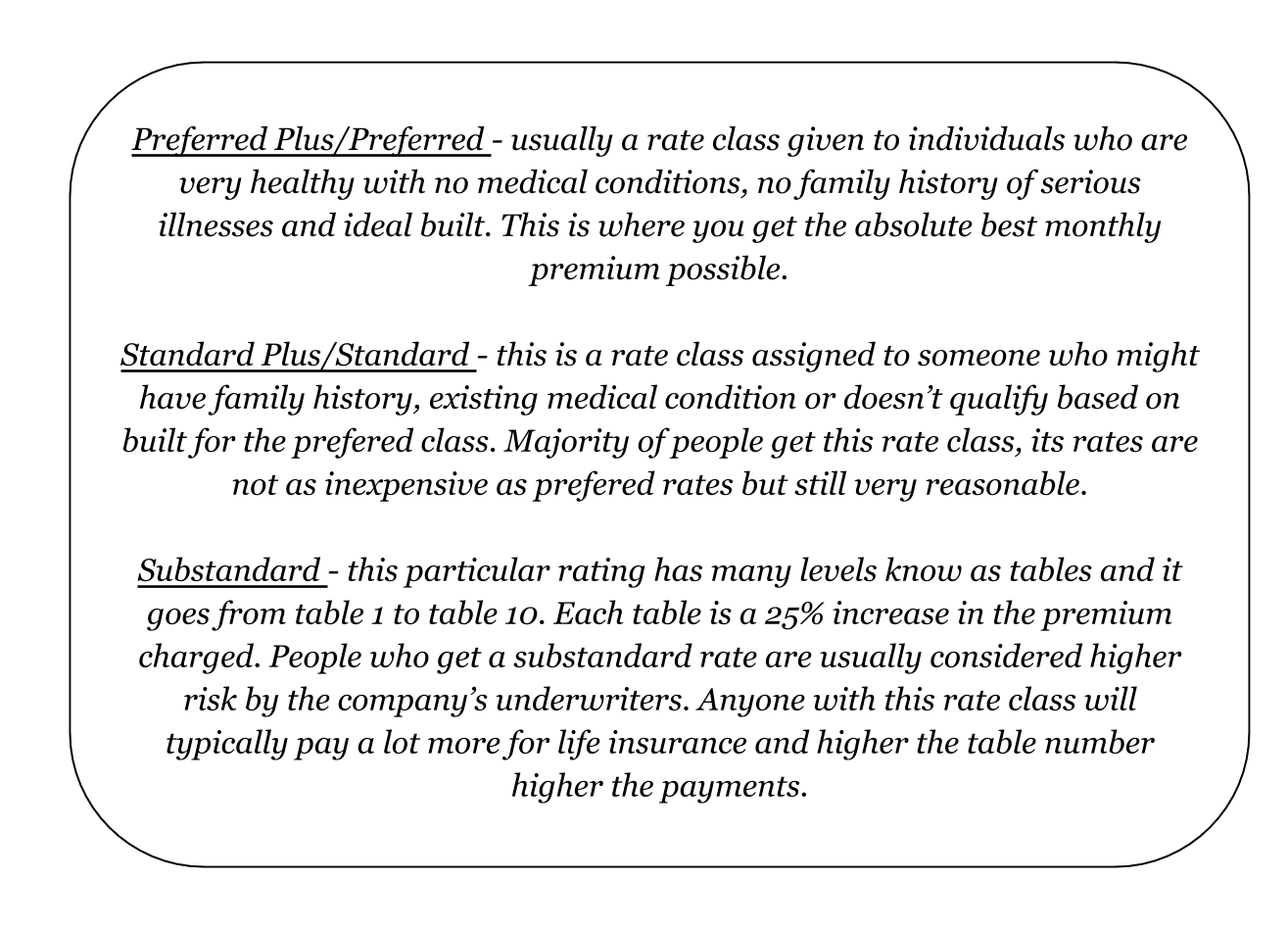

These classifications can affect how much coverage you can get at each price point.

Substandard life insurance. Insurance industry term for an individual considered below average or an impaired insurance risk due to his or her dangerous habits health condition family history of disease hazardous occupation or hobby andor residence in unhealthy surroundings. Life insurance substandard risk class. How to get a quote to get a quote at severe substandard simply use.

Another way life insurance companies balance out taking on extra risk for a substandard applicant is adding a flat extra to your premium. In the past many life insurance applications would not be acceptable due the high risk of insuring the individual in question. Win 100 amazon gift card by taking our 2 minute reader survey insuranceopedia explains substandard risk.

The answer for some companies is to not offer coverage at all or only offer substandard home insurance coverage. A flat extra is an extra payment added on top of the premiums to cushion an insurance companys risk. Not all life insurance policies are created equal.

Substandard insurance policies contain special or restrictive provisions and will have higher premiums due to the higher risk posed by the individual. Life just isnt that simple and while we can maintain our houses to an extent there are many unpreventable claims that can and often do occur that are out of our control. The policy you get wont necessarily be the same policy your neighbor gets.

Substandard life insurance if you are looking for insurance then we will provide you with insurance quotes on different types of insurance so you can find the best provider. Thats because life insurance companies use a system of classifications to determine someones health based on a series of factors about that particular individual. Improvements in underwriting processes have enabled insurance companies to create classifications of risks into standard preferred substandard and uninsurable.

Also called impaired risk. A severe substandard life insurance classification is generally applied to an applicant who is healthy enough to be approved for life insurance but due to a high risk medical condition will be asked to pay a higher premium than healthier applicants.

Image From Page 270 Of The Medical Examination For Life I Flickr

Image From Page 270 Of The Medical Examination For Life I Flickr

Life Insurance In American Samoa From 7 96 A Month

Life Insurance In American Samoa From 7 96 A Month

Life Insurance Questions Answers Quickquote

Life Insurance Questions Answers Quickquote

:max_bytes(150000):strip_icc()/financial-advisor-having-a-meeting-with-clients-1063753064-2120aacf37ab42b2b7625d0e792a857f.jpg) Insurance Risk Class Definition

Insurance Risk Class Definition

Life Insurance For Diabetics 3 Best Companies Cheap Rates

Life Insurance For Diabetics 3 Best Companies Cheap Rates

What Is A Substandard Life Insurance Risk Quotacy

What Is A Substandard Life Insurance Risk Quotacy

Your Life Insurance Rate Doesn T Match Your Quote Now What

Your Life Insurance Rate Doesn T Match Your Quote Now What

File The Medical Examination For Life Insurance And Its Associated

File The Medical Examination For Life Insurance And Its Associated

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Practical Life Insurance Examinations With A Chapter On The

Practical Life Insurance Examinations With A Chapter On The

Life Insurance Glossary Lifeinsure Com

Life Insurance Glossary Lifeinsure Com

We Are The Substandard Life Insurance Experts Carriers

We Are The Substandard Life Insurance Experts Carriers

Life Insurance Practice Exam 2 Pdf Free Download

Life Insurance Practice Exam 2 Pdf Free Download

Why Your Vaping Habit Could Raise Your Life Insurance Costs

Why Your Vaping Habit Could Raise Your Life Insurance Costs

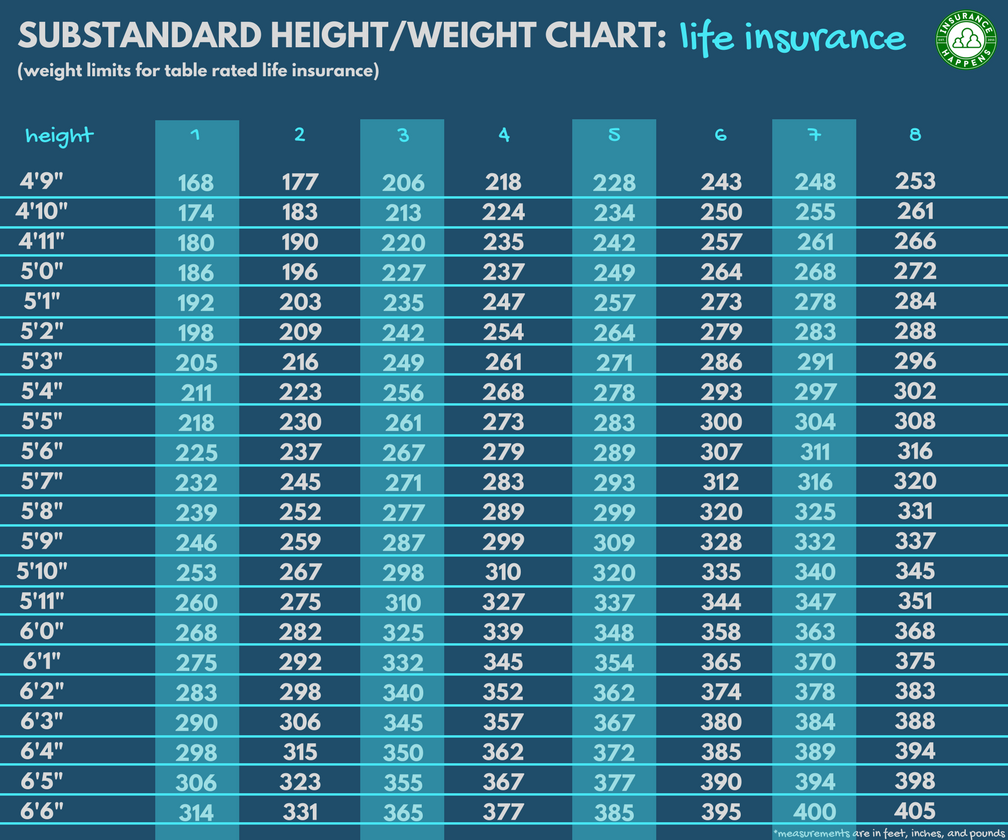

Life Insurance For Overweight Obese People Bmi Rates Weight Charts

Life Insurance For Overweight Obese People Bmi Rates Weight Charts

Practical Life Insurance Examinations With A Chapter On The

Practical Life Insurance Examinations With A Chapter On The

Substandard Underwriting Pdf Free Download

Substandard Underwriting Pdf Free Download

Life Insurance With Add Or Adhd Insurechance Com

Life Insurance With Add Or Adhd Insurechance Com