With permanent plans you have the option to surrender the policy for its accumulated cash value. A surrender charge is a charge from the cash value imposed by the insurance company for surrendering the contract early or withdrawing money early.

Solved 7 Labelle Corporation Owns A 6 5 Million Whole L

Solved 7 Labelle Corporation Owns A 6 5 Million Whole L

It is the money held in your account.

Surrender value of a life insurance policy. Also not all policies will acquire surrender value. However during the early years of a whole life insurance policy the savings portion. Cash surrender value applies to the savings element of whole life insurance policies payable before death.

Fees are taken from the cash value before you get the pay out. Whole life insurance policies also allow owners to chose where to direct dividend payments. Some life insurance policies especially variable universal and universal life insurance policies may have surrender charges for the first 10 15 years of the policy.

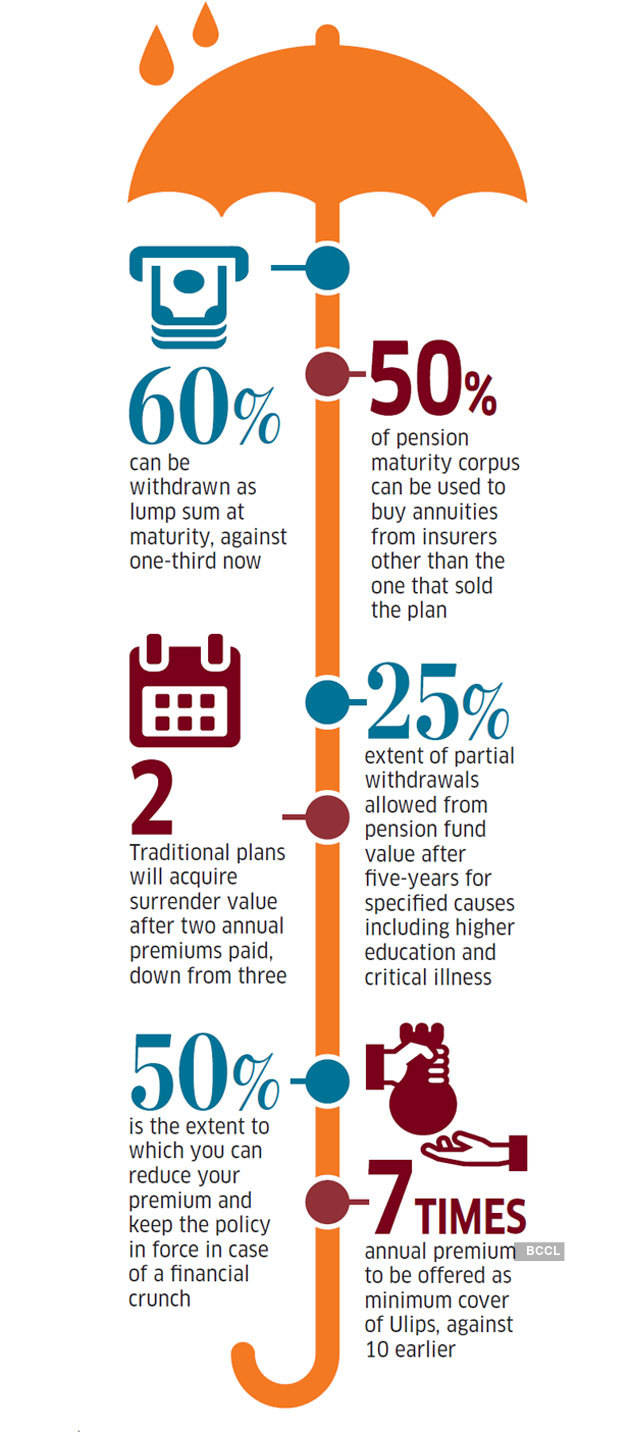

Understanding cash surrender value. A policy acquires surrender value only when premiums for full three years have been paid to the insurance company. Only policies such as ulips or endowment policies that have a savings component embedded will partially return the amount invested for life cover.

This leads to the difference between cash or account value and. When youre in the market for a life insurance policy you have a choice between a term insurance policy which is less expensive but builds no cash value and a permanent plan such as whole life universal life or variable life. Cash surrender value refers to the amount an insurance company will offer an insurance owner who chooses to give back their life.

In order to discourage policy holders from pursuing life settlements some insurance companies resort to cash surrender value. Some cash value life insurance policies levy a surrender charge if you cash them in before a certain length of time. Cash value or account value is equal to the sum of money that builds inside of a cash value generating annuity or permanent life insurance policy.

When you decide to surrender your life insurance policy you are essentially requesting to cancel the life insurance in exchange for any cash value that has accumulated. When you cash out your policy there may be fees charged by the insurance company. If you are canceling something other than a term policy you will probably have a small amount of money left after cancellationthe life insurance company will calculate this value known as the cash surrender value or the non forfeiture value.

With a whole life insurance policy this may require approval from the insurance company though any excess premium payment is held in an escrow account the value of which will be returned to policy owners upon surrender.

Why You Should Not Expect Returns From Life Insurance Policies

Why You Should Not Expect Returns From Life Insurance Policies

Most Term Insurance Policies Have Zero Surrender Value

Most Term Insurance Policies Have Zero Surrender Value

Term Life Insurance Buying Life Insurance Policy Here S Why You

Term Life Insurance Buying Life Insurance Policy Here S Why You

Cash Surrender Value Definition

Cash Surrender Value Definition

Avoid Surrendering Life Insurance Policy 1

Avoid Surrendering Life Insurance Policy 1

Most Term Insurance Policies Do Not Offer Surrender Value

Most Term Insurance Policies Do Not Offer Surrender Value

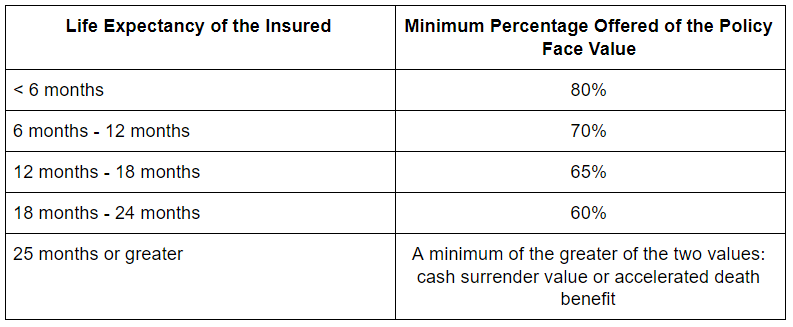

Sell Your Life Insurance Policy Why Would You Viatical

Sell Your Life Insurance Policy Why Would You Viatical

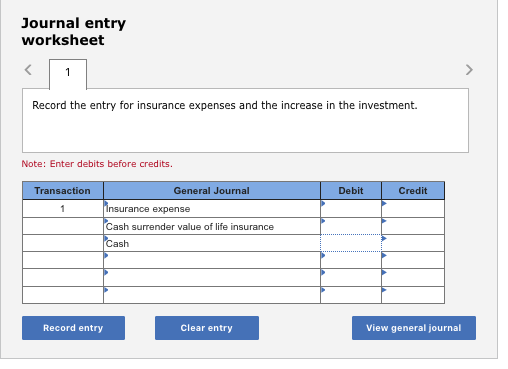

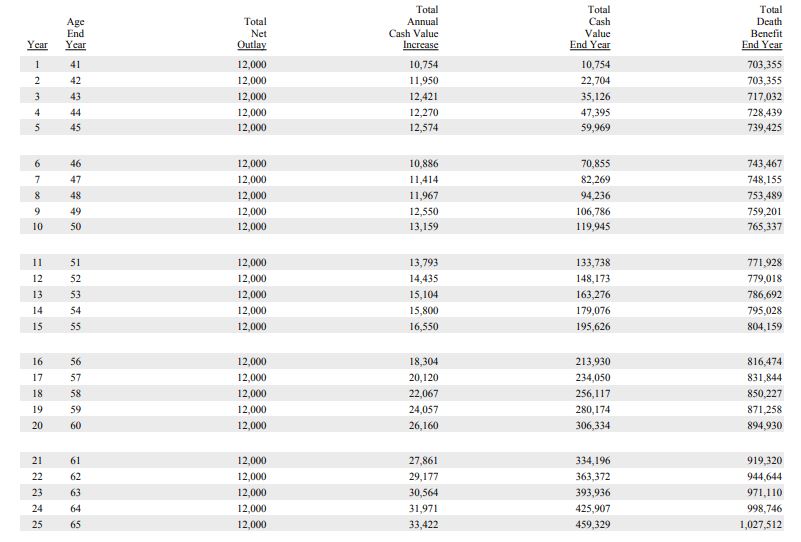

Solved 25 The Annual Increase In The Cash Surrender Valu

Solved 25 The Annual Increase In The Cash Surrender Valu

Life Insurance Policy Holder Dies 5sos How To Surrender Life

Life Insurance Policy Holder Dies 5sos How To Surrender Life

Loan And Surrender Value For Lic Policy Full Details In

Loan And Surrender Value For Lic Policy Full Details In

Cash Surrender Value Definition What Does Cash Surrender Value

Cash Surrender Value Definition What Does Cash Surrender Value

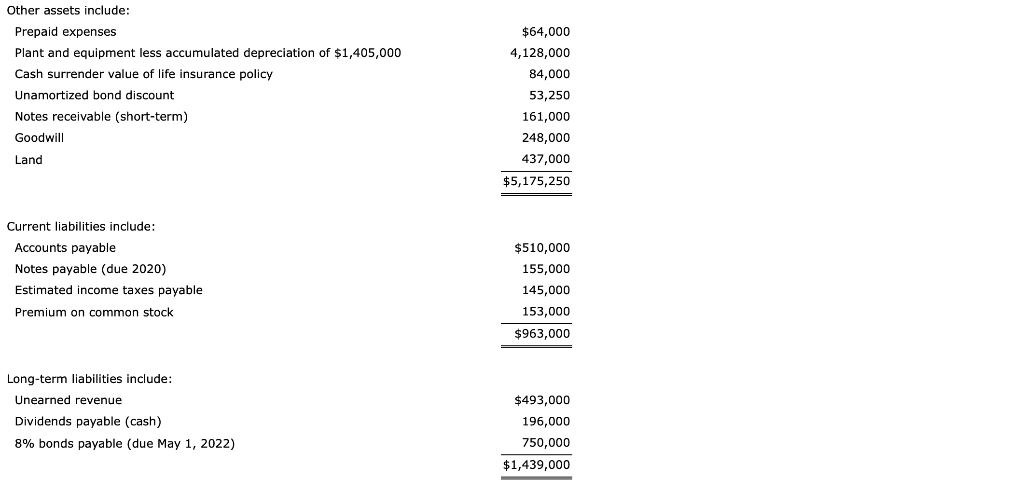

Solved Investments In Land 183000 Cash Surrender Value Of

Solved Investments In Land 183000 Cash Surrender Value Of

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Life Insurance Corporation Of India Eligibility Condition And

Life Insurance Corporation Of India Eligibility Condition And

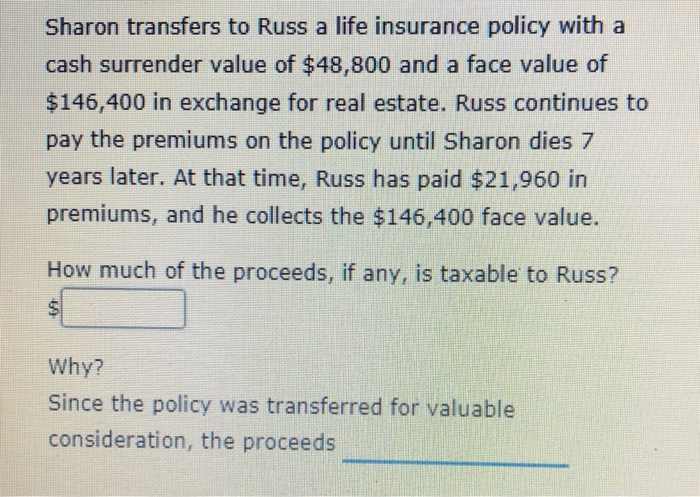

Solved Sharon Transfers To Russ A Life Insurance Policy W

Solved Sharon Transfers To Russ A Life Insurance Policy W

Benefits Of Cash Value Life Insurance Youtube

Benefits Of Cash Value Life Insurance Youtube

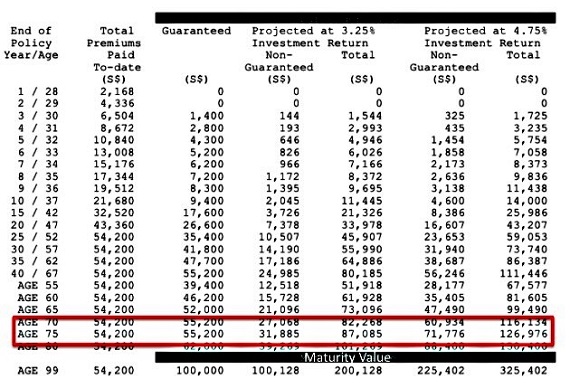

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

How To Surrender Lic Policy Before Maturity Lic Policy

How To Surrender Lic Policy Before Maturity Lic Policy

Cash Surrender Value In Balance Sheet

Easy Ways To Close An Lic Policy Before Maturity 9 Steps

Easy Ways To Close An Lic Policy Before Maturity 9 Steps

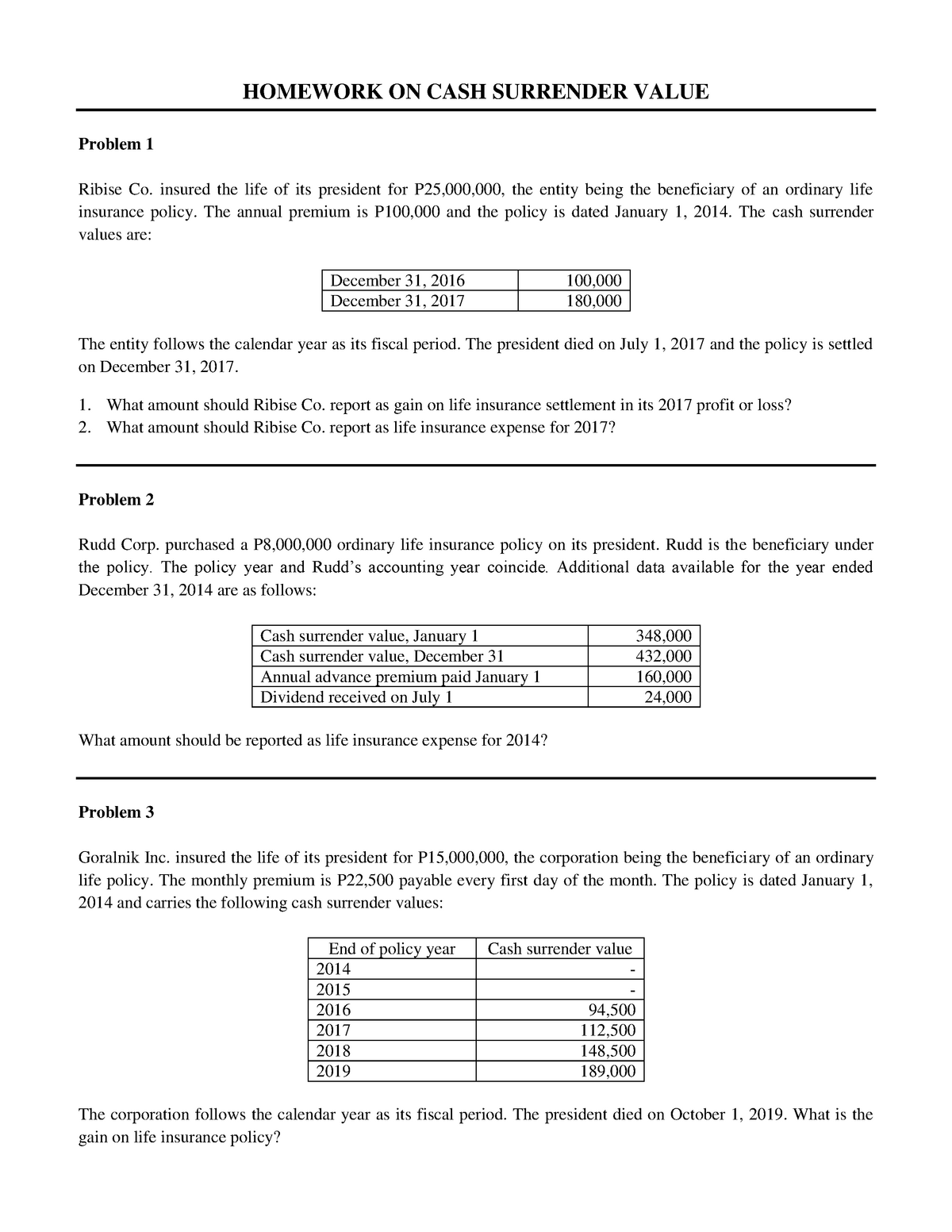

Hw On Cash Surrender Value Accountancy Bsa Dlsu Studocu

Hw On Cash Surrender Value Accountancy Bsa Dlsu Studocu

Cash Surrender Value Of Life Insurance What Is Cash Surrender

Cash Surrender Value Of Life Insurance What Is Cash Surrender