If you have accumulated a sizable cash value over the life of your permanent life insurance policy and do not intend to use these funds yourself you may choose to leave a larger death benefit to. Any amount you receive over the amount of premiums you paid is taxable income.

Variable Universal Life Insurance Vul Success Financial Freedom

Variable Universal Life Insurance Vul Success Financial Freedom

Cash value life insurance is a form of permanent life insurance that features a cash value savings component.

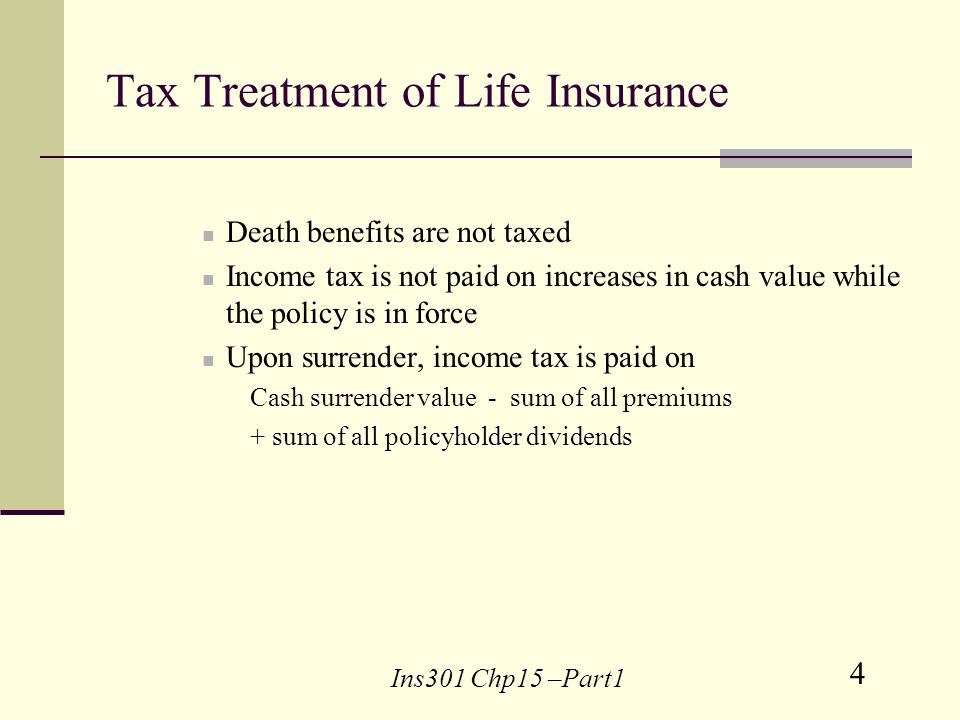

Tax on life insurance cash value. If you cash in a life insurance policy you may need to pay tax on the cash surrender value. Taxes when cashing out a life insurance policy. Calculating the tax on the cash surrender value of a life insurance policy.

It is the amount you can terminate your policy and receive. The gain on the surrender of a cash value policy is the difference between the gross cash value paid out plus any loans outstanding and your basis in the policy. The most obvious benefit to life insurance is the death benefit what your beneficiaries receive when you die.

Each policy has a. Think of your life insurance policy like a savings account. However some policies such as whole life policies have an investment component that lets you build cash value inside the policy that you can withdraw while.

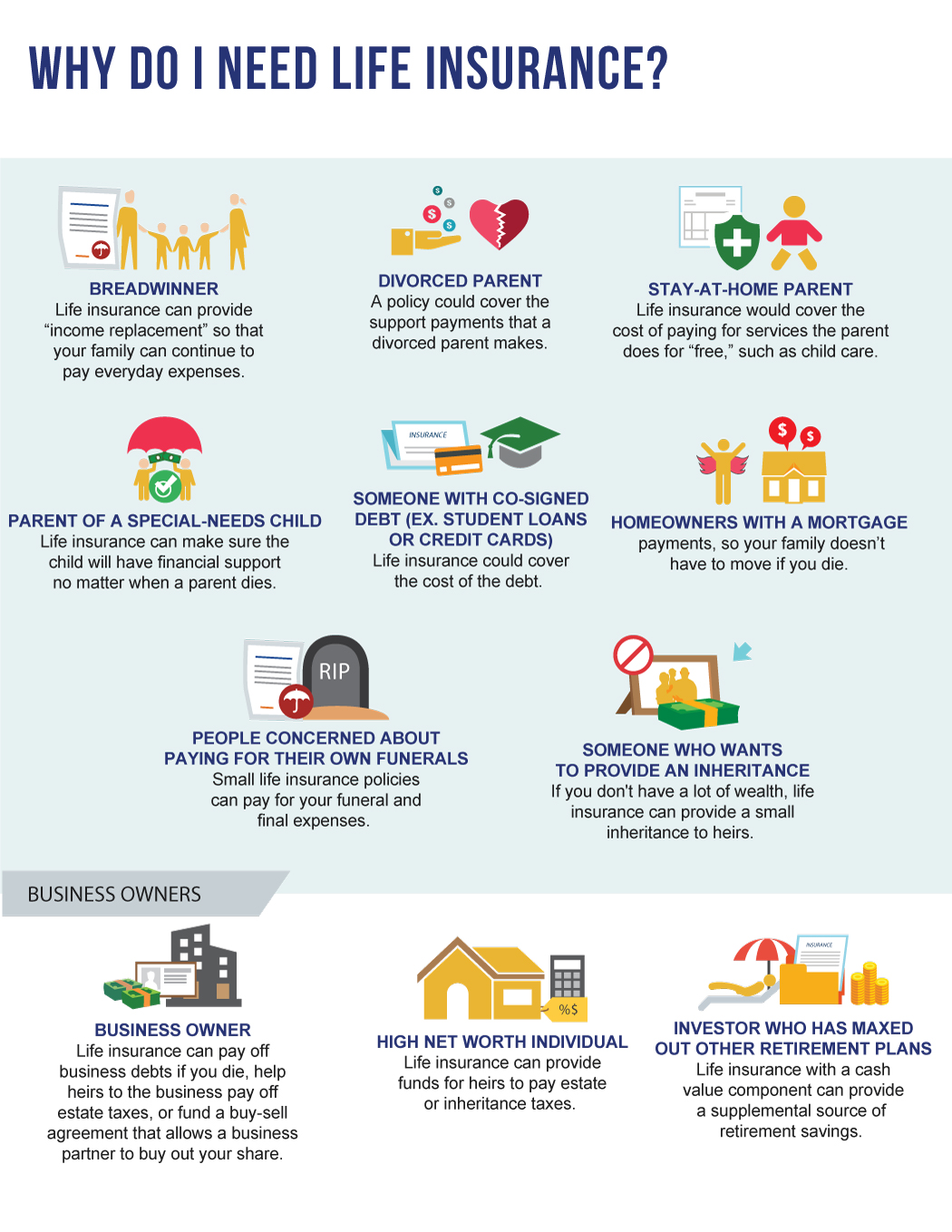

Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. The policyholder can use the cash value for many purposes such as a source of loans. How to calculate taxable income when cashing out life insurance pre death.

Although pretax contributions offer certain income tax advantages one tradeoff is that youll be required to pay a small tax on the economic value of the pure life insurance in the policy ie the difference between the cash value and the death benefit each year. The insurance company will cancel your policy and mail you a check for your account balance. Tax implications for the cash surrender of life insurance if your life insurance policy has cash value you can take out your money whenever you want through a cash surrender.

Most of the time proceeds arent taxable. Cash surrender value comes only with whole life insurance never with term. That amount includes both what you put in and what profit you made.

But there are certain. Your whole life or variable life insurance policy could be a source of cash while youre still alive. If you surrender your cash value life insurance policy any gain on the policy will be subject to federal and possibly state income tax.

The Guide To Tax Free Wealth 2019 2020 Beyond Learn How The

The Guide To Tax Free Wealth 2019 2020 Beyond Learn How The

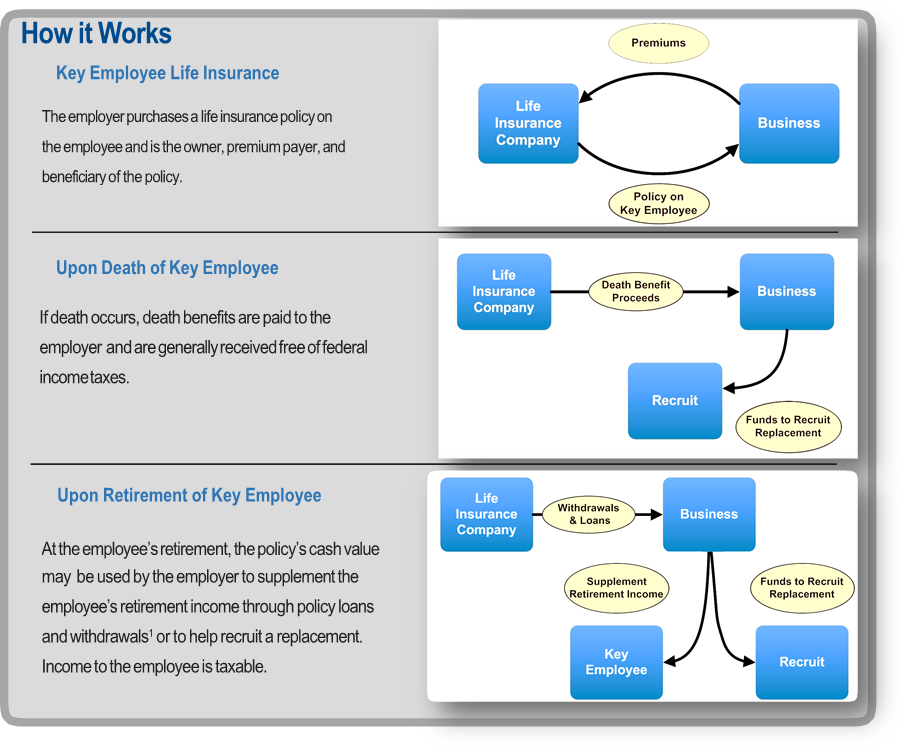

Key Employee Life Insurance Gulfport Ms Mayfield Associates

Key Employee Life Insurance Gulfport Ms Mayfield Associates

Calameo What Is Whole Life Insurance

Calameo What Is Whole Life Insurance

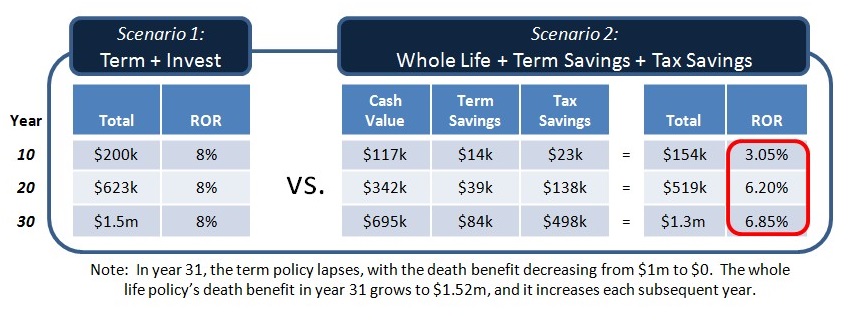

The Whole Story The True Rate Of Return Of Permanent Life

The Whole Story The True Rate Of Return Of Permanent Life

Types Of Life Insurance Term Ppt Download

Types Of Life Insurance Term Ppt Download

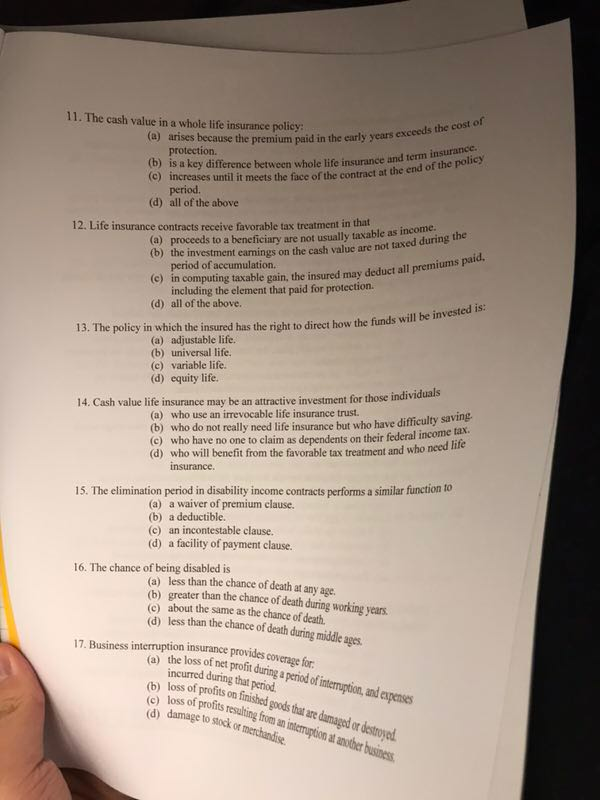

Solved 11 The Cash Value In A Whole Life Insurance Polic

Solved 11 The Cash Value In A Whole Life Insurance Polic

1 2018 Quiz Review Ppt Background Longevity Risk Background

1 2018 Quiz Review Ppt Background Longevity Risk Background

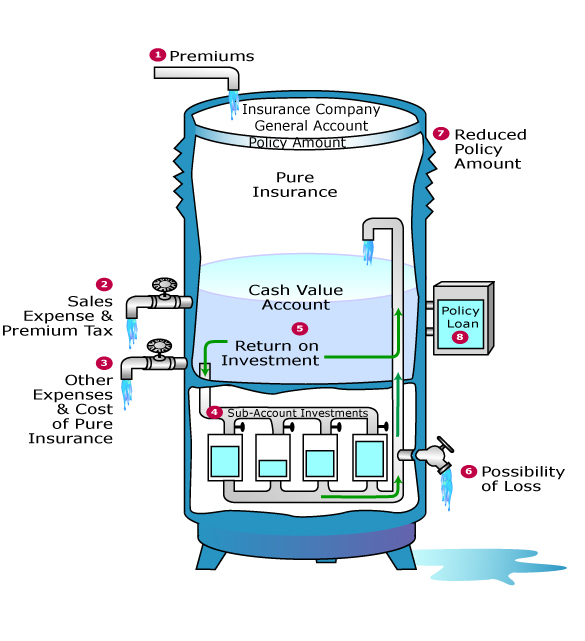

Whole Life Insurance How It Works

Whole Life Insurance How It Works

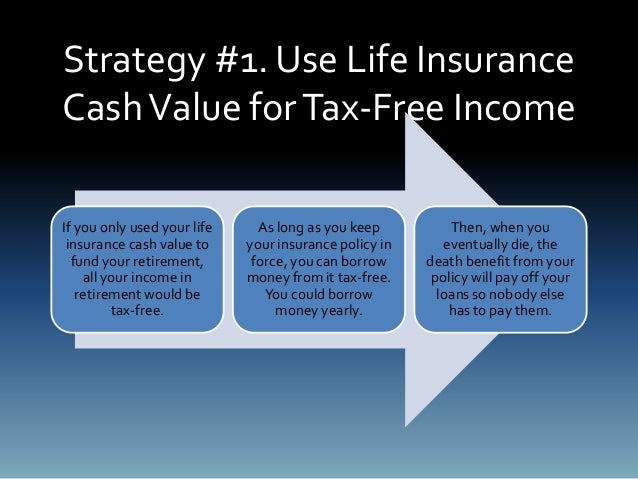

Cash Value Life Insurance In Retirement Planning Insurance Fiduciary

Cash Value Life Insurance In Retirement Planning Insurance Fiduciary

Cash Value Life Insurance May Be One Of The Last Tax Sanctuaries

Cash Value Life Insurance May Be One Of The Last Tax Sanctuaries

Do You Really Need Life Insurance Legacy Wealth Advisors

Do You Really Need Life Insurance Legacy Wealth Advisors

Understanding Life Insurance 2013 Strength Of Materials Studocu

Understanding Life Insurance 2013 Strength Of Materials Studocu

Faqs One Million Life Insurance With Half Million Guaranteed

Faqs One Million Life Insurance With Half Million Guaranteed

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

Are Withdrawals From A Cash Value Life Insurance Policy Ever Tax

Are Withdrawals From A Cash Value Life Insurance Policy Ever Tax

Using Cash Value Life Insurance For Retirement Savings Coastal

Using Cash Value Life Insurance For Retirement Savings Coastal

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

Create Tax Advantaged Retirement Income You Cant Outlive

Create Tax Advantaged Retirement Income You Cant Outlive

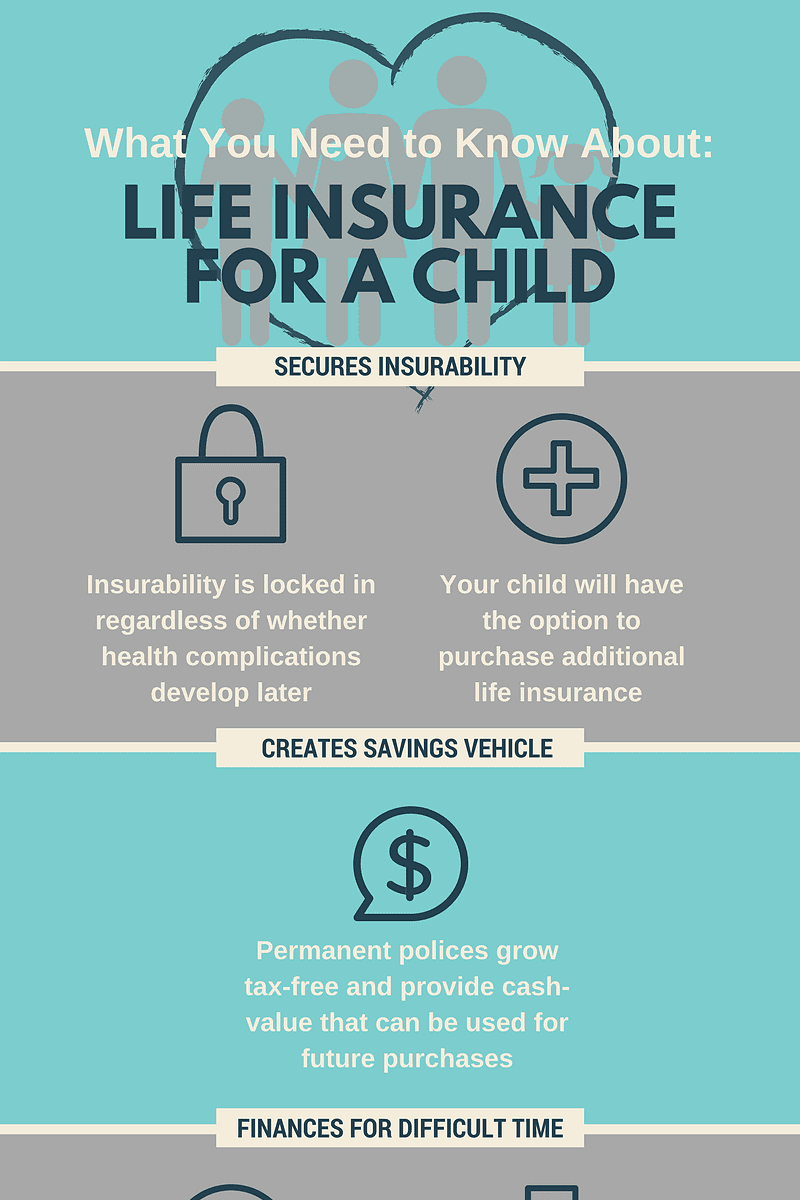

What You Need To Know About Children S Life Insurance Infographic

What You Need To Know About Children S Life Insurance Infographic

Life Insurance Universal Life Insurance Vce Publications

Life Insurance Universal Life Insurance Vce Publications