Term life insurance a contract that provides a death benefit but no cash build up or investment component. There is no savings component as found in a whole life insurance product.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term.

Term life insurance policy definition. Term life insurance policy definition if you are looking for the best insurance quotes then our free online service will give you the information you need in no time. Term life insurance policy definition if you are looking for the best deals on insurance then our insurance quotes service can provide you with a wide range of options. The policys purpose is to give insurance to.

A term life. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Term life insurance a life insurance policy that provides coverage only for a certain period of time.

Another term for a term life insurance policy. Simplest and usually the cheapest type of life insurance that stays in effect for a specified period or until a certain age of the insured. A life insurance policy which provides a stated benefit upon the holders death provided that the death occurs within a certain specified time period.

If the insured dies during the time period specified in the. The premium remains constant only for a specified term of years and the policy is usually renewable at the end of each term. A life insurance policy that is active for the entirety of the policyholders life.

Term life policies have no value other than the guaranteed death benefit. It pays the face amount of the policy in case the insured dies within the coverage period term but pays nothing if he or she outlives it. However the policy does not provide any returns beyond the stated benefit unlike an insurance policy which allows investors to share in returns from the insurance.

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. Permanent life insurance policies offer a cash value component that makes them more expensive than term policies and is usually only a good option for people with particular circumstances. Also unlike in whole life insurance.

Term life insurance policy definition if you are looking for quotes on different types of insurance then we can give you insurance quotes that will help you find what you are looking for.

Term Life Insurance Definition It S Love Insurance Quotacy

Term Life Insurance Definition It S Love Insurance Quotacy

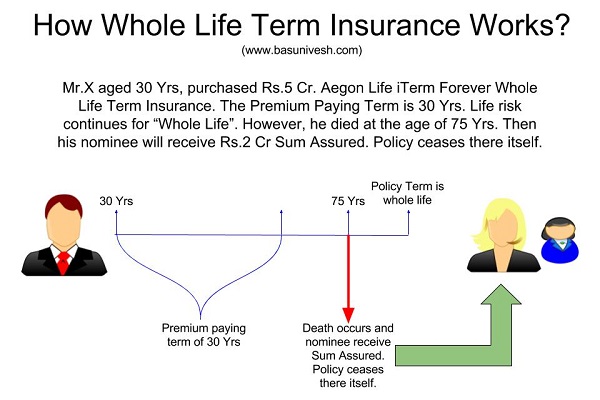

Canonprintermx410 25 Luxury Whole Insurance Definition

Canonprintermx410 25 Luxury Whole Insurance Definition

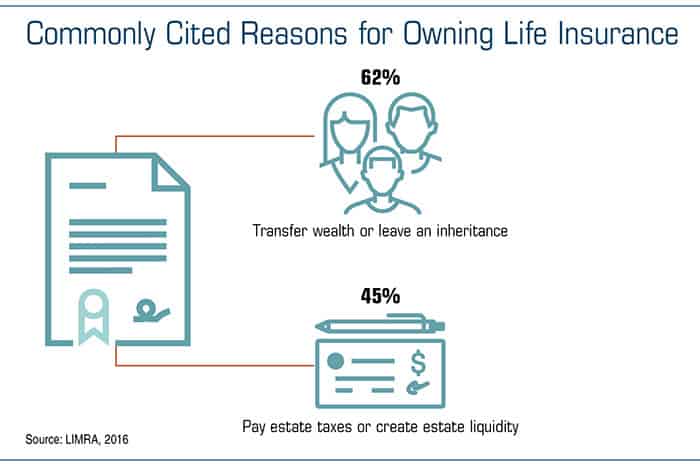

Estate Planning Scranton Financial Group Of South Windsor

Estate Planning Scranton Financial Group Of South Windsor

State Life Policy Chart Parta Innovations2019 Org

State Life Policy Chart Parta Innovations2019 Org

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

Endowment Vs Whole Life Insurance Difference And Comparison Diffen

Endowment Vs Whole Life Insurance Difference And Comparison Diffen

What Happens When My Term Life Insurance Policy Ends Quickquote

What Happens When My Term Life Insurance Policy Ends Quickquote

Is Life Insurance A Smart Investment

Is Life Insurance A Smart Investment

Group Term Life Insurance An Incredibly Easy Method That Works For

Group Term Life Insurance An Incredibly Easy Method That Works For

Term Insurance Best Term Plans Policy Online In India 2020

Term Insurance Best Term Plans Policy Online In India 2020

What Are The Different Types Of Term Life Insurance Policies Pages

What Are The Different Types Of Term Life Insurance Policies Pages

Life Insurance Policy Types Of Life Insurance Policies 1

Life Insurance Policy Types Of Life Insurance Policies 1

Basic Definitions Associated With Term Life Insurance Business

Basic Definitions Associated With Term Life Insurance Business

Life Insurance Do Intelligent People Buy Life Insurance

Life Insurance Do Intelligent People Buy Life Insurance

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

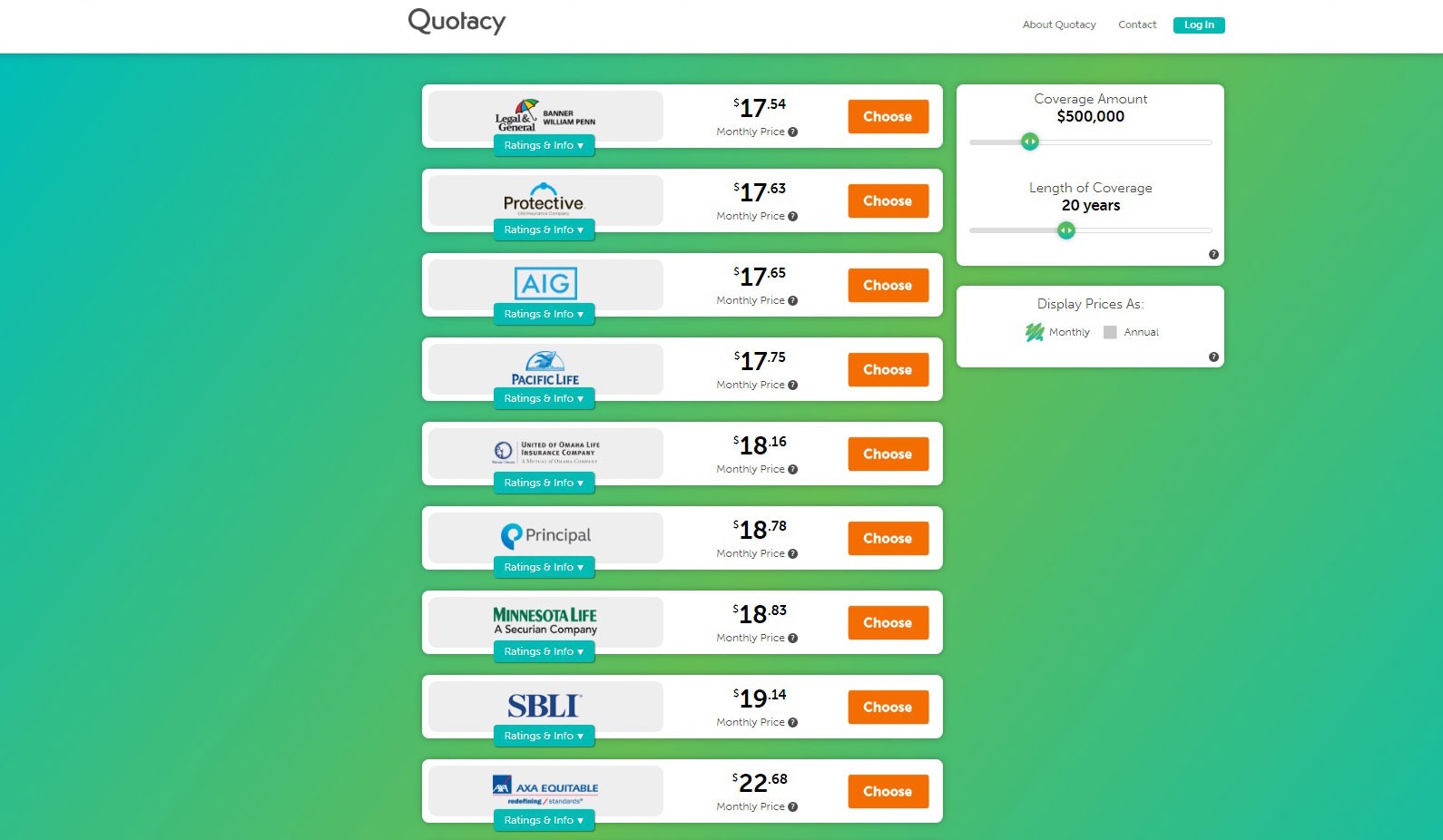

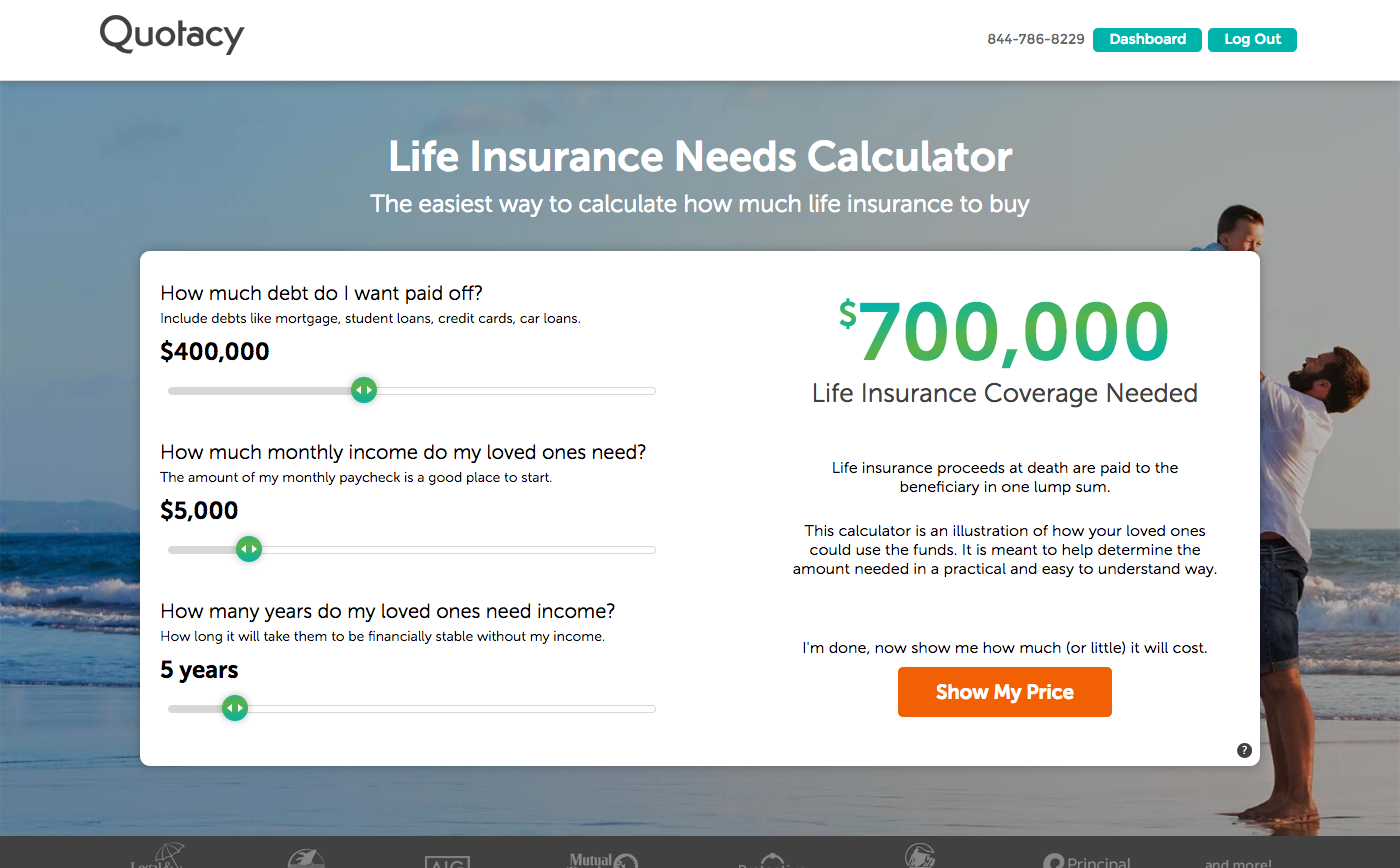

What Is Term Life Insurance What Is Term Life Quotacy

What Is Term Life Insurance What Is Term Life Quotacy

/GettyImages-475702616-3d8d1ec251704afbbd1a3f9580d63bcb.jpg) The Truth About Endowment Life Insurance Policies

The Truth About Endowment Life Insurance Policies

![]() Understanding The Different Types Of Life Insurance Policies

Understanding The Different Types Of Life Insurance Policies

Advantages Of Whole Life Insurance Policies Vs Term Life Policy

Advantages Of Whole Life Insurance Policies Vs Term Life Policy

Bip America News Types Of Life Insurance Policies Life Insurance

Bip America News Types Of Life Insurance Policies Life Insurance

Types Of Life Insurance Aig Direct

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates