An alternative to whole life before you decide which is best for you consider whether youll need life insurance in 20 or 30 years after a term policy expires. Deciding which to purchase is a personal decision that should be based on the financial needs of your family as well as your financial goals.

Whole Life Vs Term Life Insurance What S The Difference Thestreet

Whole Life Vs Term Life Insurance What S The Difference Thestreet

We are a participant in the amazon services llc associates program designed to provide a means for us to earn fees from qualifying purchases at no additional cost to you.

Term life or whole life insurance which is best. Term life insurance is purchased for a specific period of time usually from one to twenty years. For most term life insurance is the best choice. One of the first steps in choosing a policy is deciding which type of policy you will be needing.

Sadly whole life insurance is often sold. The main difference between term life insurance and whole life insurance. The main purpose of life insurance is to provide for your financial dependents in the event of your death.

Please read our disclosure and disclaimer. Skip to main content. Find out more by contacting an insurance agent in your area.

Some companies offer 30 year terms if you are under age 50. Term although the word term is a common phrase among insurance professionals many people are confused about the concepts of term versus whole life insurance. Deciding on a life insurance policy can be difficult especially when dealing with the insurance world jargon.

Should you buy term life or whole life insurance. In this blog post we will break down which policy option is best for doctors and why. What is term life insurance.

Which life insurance is best to buy term or whole. Term life and whole life are two popular variations of life insurance policies. Determining which life insurance is right for you and your family can be a confusing topic.

The two most common types of life insurance policies are term life and whole life. At the end of the term you receive no return on the money that you paid for the insurance but if you die before the term is over then your loved ones will receive the full amount of the policy. With term life insurance when the insured person dies it just pays the face amount of the policy to the named beneficiary.

Simply put a term policy provides coverage for a set number of years. Now that you know the differences between term life insurance and whole life insurance you can make an informed choice to find the best life insurance solution for you and your family. Term vs whole life insurance.

This page or article may contain affiliate links. While the basic idea of providing much needed cash in the event of your death is the same there are some big. Term life insurance is simpler and works like your car or home insurance.

Term life vs whole life insurance can be an easy decision.

Term Vs Whole Life Insurance Which Is Right For You The Budget Mom

Term Vs Whole Life Insurance Which Is Right For You The Budget Mom

Term Insurance Vs Whole Life Insurance Which Is Best In February 2020

Term Insurance Vs Whole Life Insurance Which Is Best In February 2020

Best Life Insurance Under 30 2014 Beda Term Life Dan Whole Life

Best Life Insurance Under 30 2014 Beda Term Life Dan Whole Life

The Importance Of Life Insurance Term Vs Whole Wealthlenial

The Importance Of Life Insurance Term Vs Whole Wealthlenial

Term Vs Whole Life Insurance Which Is Best For Vector Image

Term Vs Whole Life Insurance Which Is Best For Vector Image

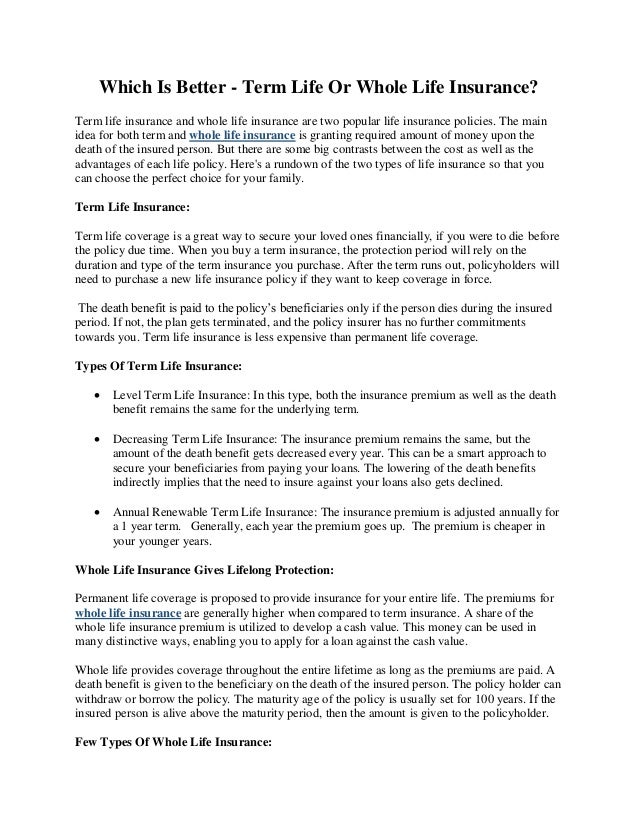

Which Is Better Term Life Or Whole Life Insurance

Which Is Better Term Life Or Whole Life Insurance

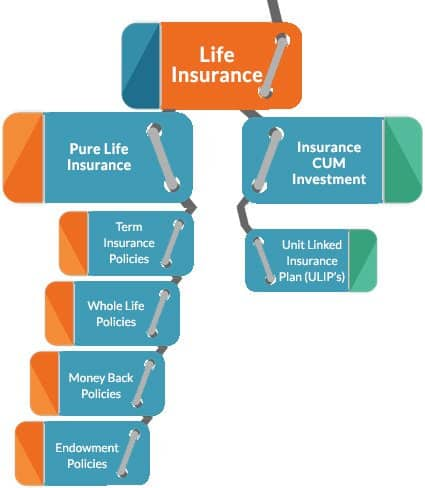

Life Insurance Online Life Insurance Plans Polices In India

Life Insurance Online Life Insurance Plans Polices In India

Term Vs Whole Life Insurance What The Experts Say The Good Men

Term Vs Whole Life Insurance What The Experts Say The Good Men

How Well Do You Understand The Difference Between The Two Types Of

How Well Do You Understand The Difference Between The Two Types Of

Whole Life Vs Term Life Insurance Malaysia Policystreet Blog

Whole Life Vs Term Life Insurance Malaysia Policystreet Blog

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

Globe Life On Twitter Do We Sell Term Life Insurance Or Whole

Globe Life On Twitter Do We Sell Term Life Insurance Or Whole

Term Vs Whole Life Insurance Which Is Better

Term Vs Whole Life Insurance Which Is Better

Term Life Or Whole Life Which Insurance Is Best For You

Term Life Or Whole Life Which Insurance Is Best For You

An Easy To Understand Comparison Between Term Life And Whole Life

An Easy To Understand Comparison Between Term Life And Whole Life

Complete Guide To Life Insurance How To Buy Life Insurance

Complete Guide To Life Insurance How To Buy Life Insurance

Term Insurance Vs Whole Life Insurance Policy

Term Insurance Vs Whole Life Insurance Policy

Term Life Insurance Vs Whole Life Insurance Johnson

Term Life Insurance Vs Whole Life Insurance Johnson

Term Vs Whole Life Insurance Which Is Better Zing Blog By

Term Vs Whole Life Insurance Which Is Better Zing Blog By

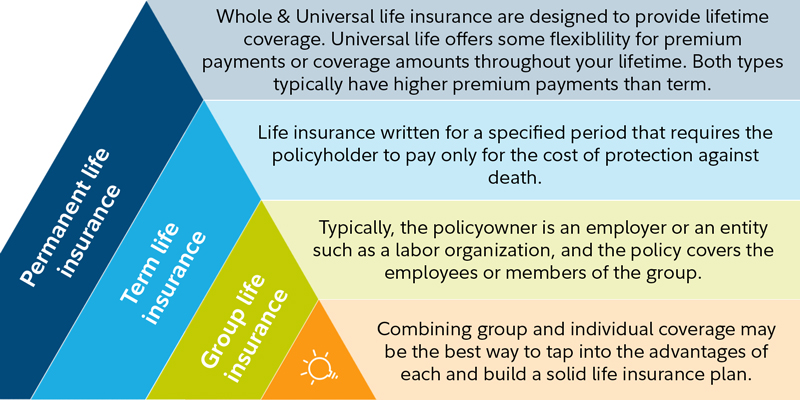

Universal Life Insurance Vs Term Which Is The Best Life Insurance

Universal Life Insurance Vs Term Which Is The Best Life Insurance

Term Vs Whole Life Insurance Which Is Best For You The Motley

Term Vs Whole Life Insurance Which Is Best For You The Motley