Policy holders can choose to receive the cash value as a lump sum or take out a bank loan using the policys cash value as collateral. Which type of life insurance is better term or cash value.

Cash value is one of them.

Term life insurance with cash value. Traditionally cash value life insurance has higher premiums than term insurance because. These policies are more expensive than term life insurance and the cash value component offers some additional flexibility. Term life insurance is what those in the know call pure insurance.

Life insurance can give your family an additional financial safety net. Some types of life insurance policies including whole life universal life and variable life can accumulate cash value during the policyholders lifetime. Or you simply cant afford to pay your cash value life insurance plan anymore and want to know what you can get out of it if you cancel.

You may have got convinced into buying an expensive permanent life insurance policy like a whole life or universal life a while back and now realize you may have been better off simply getting a term life insurance policy. Why term life insurance doesnt have a cash value. Permanent life insurance also called cash value life insurance is an entire category of life insurance plans that last as long as you pay the premiums and has a cash value component.

Cash value insurance is permanent life insurance because it provides coverage for the policyholders life. Term life insurance offers comparatively affordable protection for policyholders. Heres how to make the cash value of your life insurance policy benefit you or your beneficiaries instead of the.

Term life does not. There are big differences between term life insurance and the multiple types of permanent life products like whole life and universal life. Insurance buyers have been asking this question for generations.

Does term life have a cash value. Cash value life insurance also known as permanent life insurance doesnt expire and comes with a tax deferred savings component. Whole life and universal life policies offer this benefit.

Cash value life insurance policies typically cost 6 to 10 times more than term life insurance for the same death benefit amount. Term life policies dont. Variable life and universal life all have built in cash value.

That is you pay premiums at a set rate for a set period of time like 10 20 or 30 years and if you die while youre covered by the policy the insurer will pay your beneficiaries a set amount. When choosing between these two fundamentally different alternatives youll need to think about the amount of coverage you need the amount of money you can afford to spend and the length of time you need the coverage to continue. However part of the reason its not as expensive as whole life insurance is because there.

Like all life insurance term life is designed to provide for loved ones in the event of an untimely death.

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

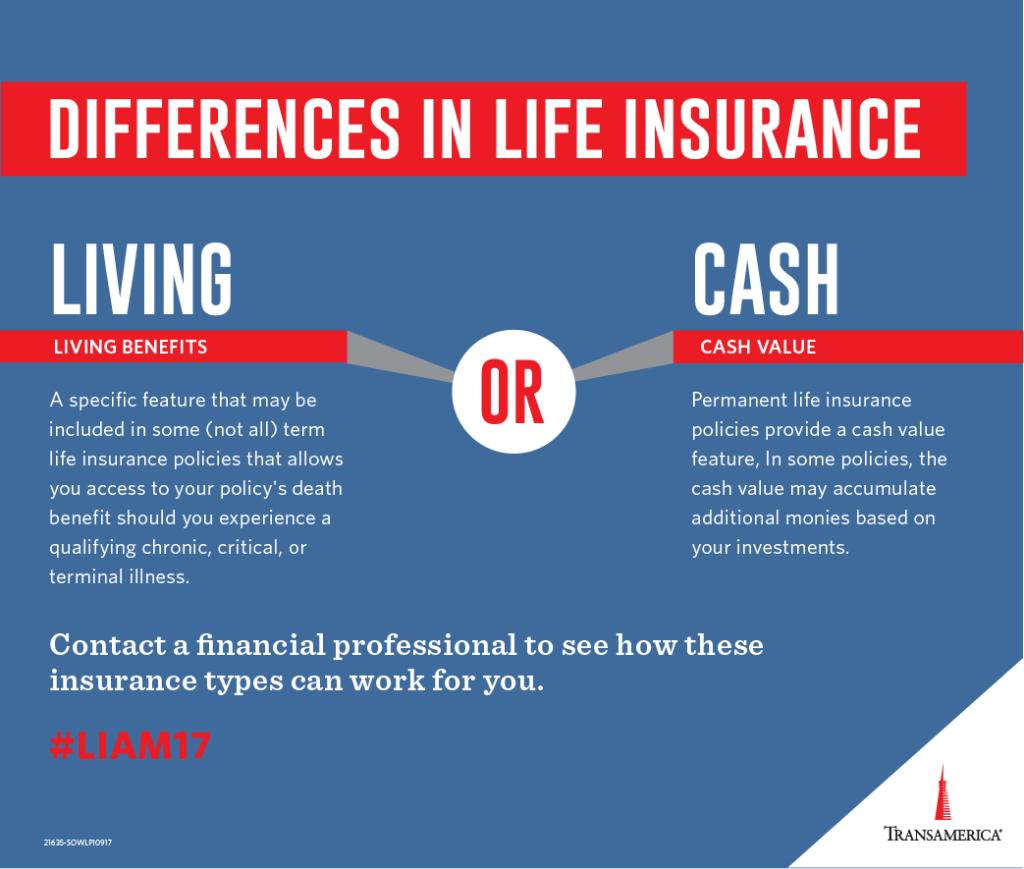

Transamerica On Twitter Two Options To Consider When Choosing

Transamerica On Twitter Two Options To Consider When Choosing

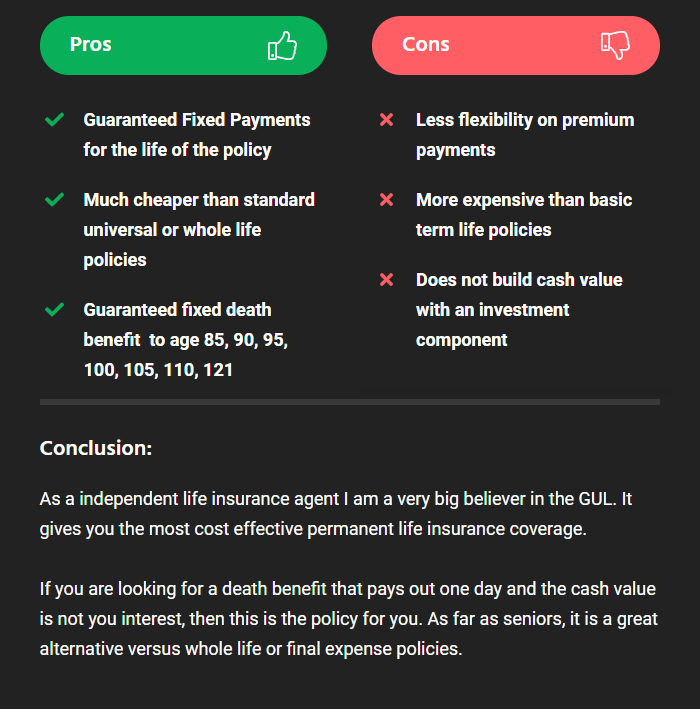

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

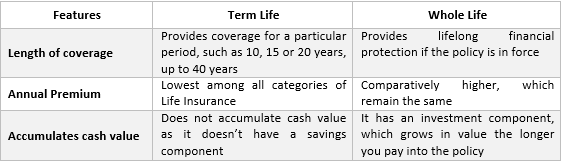

What Is Term Life Insurance And How It Works The Smart Investor

What Is Term Life Insurance And How It Works The Smart Investor

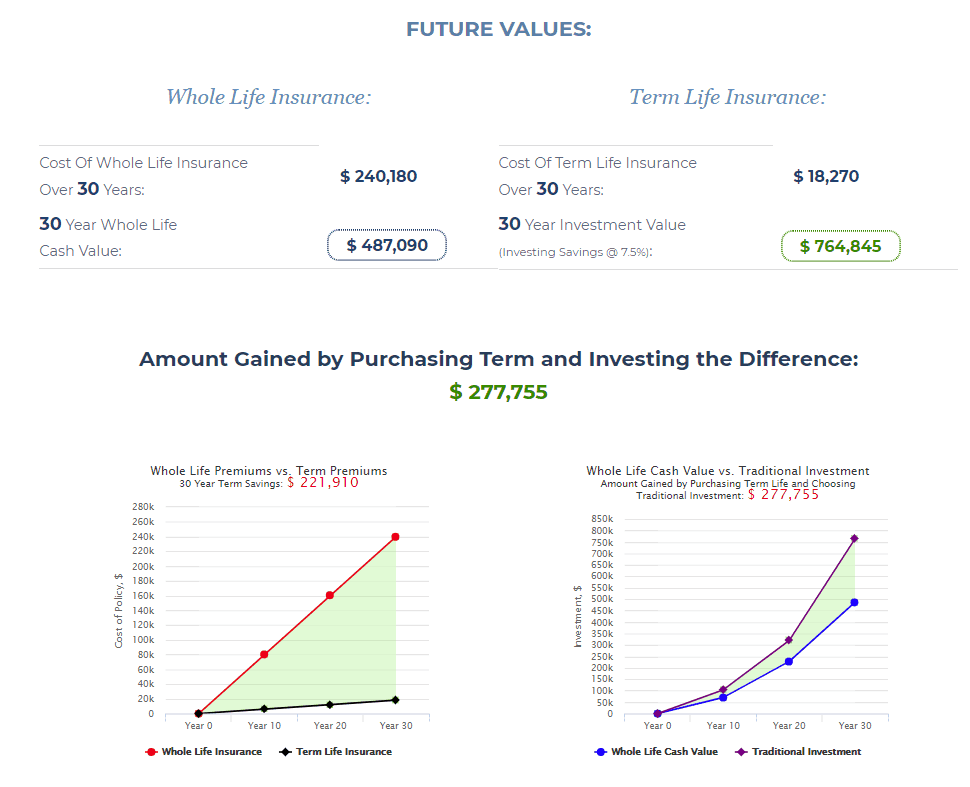

Is Whole Life Insurance Right For You

Is Whole Life Insurance Right For You

Term Life Insurance Definition

Term Life Insurance Definition

Suze Orman On Cash Value Life Insurance Vs Term Life Insurance

Suze Orman On Cash Value Life Insurance Vs Term Life Insurance

Term Life Vs Permanent Life What Is Best

Term Life Vs Permanent Life What Is Best

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

Term Life Vs Universal Life Insurance

Term Life Vs Universal Life Insurance

9 Different Types Of Life Insurance Explained

9 Different Types Of Life Insurance Explained

Make Life Insurance Choice Easier With Financial Planning Unbroke

Make Life Insurance Choice Easier With Financial Planning Unbroke

What Is The Cash Value Of Term Life Insurance

What Is The Cash Value Of Term Life Insurance

Different Types Of Life Insurance Explanation The Ultimate Guide

Different Types Of Life Insurance Explanation The Ultimate Guide

Whole Life Insurance Definition

Journal Bringing Real Clarity And Understanding Of Cash Value Life

Journal Bringing Real Clarity And Understanding Of Cash Value Life

Beneficiary Cash Value Life Insurance Policy Endowment Policy Face

Beneficiary Cash Value Life Insurance Policy Endowment Policy Face

What Is The Difference Between Term Life And Whole Life Policy

What Is The Difference Between Term Life And Whole Life Policy

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc