Your premiums go toward both the cash value and the death benefit. Three types of life insurance if you are looking for low cost insurance then our online insurance quotes service will help you find a provider that works for you.

10 Things You Need To Know About Life Insurance Without An Exam

10 Things You Need To Know About Life Insurance Without An Exam

Because the life insurance coverage of a non level policy decreases over time you might expect this type of life insurance to cost less.

Three types of life insurance. Accidental death insurance is a type of limited life insurance that is designed to cover the insured should they die as the result of an accident. This money can be used to help pay off a mortgage pay for a childs education pay for the deceased persons estate taxes and other payments. Three types of life insurance if you are looking for a convenient way to get quotes on different types of insurance then look no further than our insurance quotes service.

For more on the different types of term life insurance click here. Whole life universal and variable life. The policyholders of universal life policies can change the premium and death benefit amounts without getting a new policy.

Term life insurance policies are the simplest most popular and the most often purchased. This type of life policy pays the lender the remainder of your mortgage which decreases as you make your monthly loan payments. When many people think of life insurance policies they usually dont think of all the types of life insurance they only think term.

There are three major types of whole life or permanent life insurance. Whole life whole life insurance is the most basic type of permanent insurance. Accidents run the gamut from abrasions to catastrophes but normally do not include deaths resulting from non accident related health problems or suicide.

Universal life insurance has a cash value just like a whole life insurance policy. Life insurance provides your loved ones or beneficiaries with a sum of money when you die. But in the life insurance menu of options its not the only choice.

Here is an introduction to the three main types of permanent insurance. But theres a twist. We explain the types of life insurance so that you can make the best decision when youre ready to buy.

In 2003 virtually all 97 percent of the term life insurance bought was level term. Whole life or permanent insurance pays a death benefit whenever you dieeven if you live to 100.

Three Kinds Of Life Insurance Policies Bw Businessworld

Three Kinds Of Life Insurance Policies Bw Businessworld

Different Types Of Life Insurance Policies Why To Know Them

Different Types Of Life Insurance Policies Why To Know Them

Life Insurance Different Types Of Life Insurance Policies

Life Insurance Different Types Of Life Insurance Policies

Life Insurance Types Explained Term Life Whole Life Universal Life

Life Insurance Types Explained Term Life Whole Life Universal Life

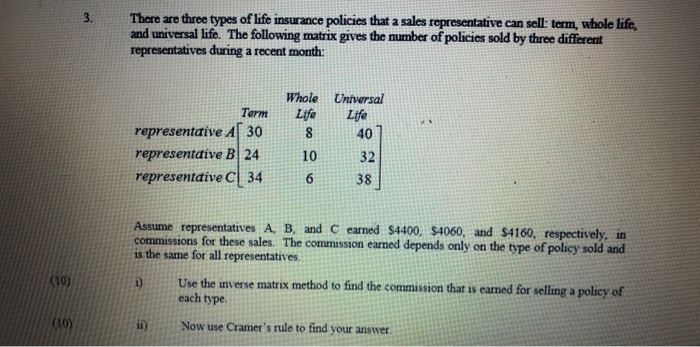

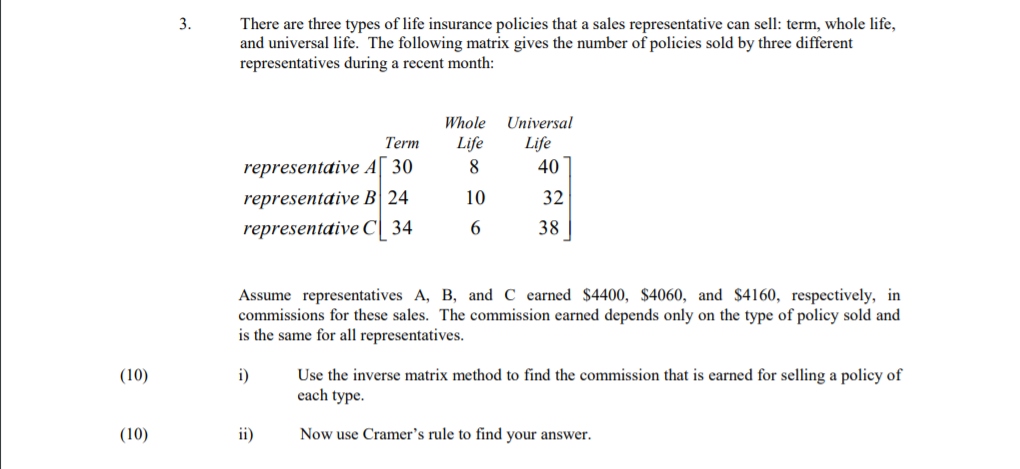

Solved There Are Three Types Of Life Insurance Policies T

Solved There Are Three Types Of Life Insurance Policies T

What Kind Of Life Insurance Do I Need Term Permanent Or Both

What Kind Of Life Insurance Do I Need Term Permanent Or Both

Different Types Of Life Insurance Policies And Provisions Pages 1

Different Types Of Life Insurance Policies And Provisions Pages 1

Life Insurance For Seniors Top 7 Mistakes To Avoid Rates Faqs

Life Insurance For Seniors Top 7 Mistakes To Avoid Rates Faqs

Three Types Of Cash Value Life Insurance

Three Types Of Cash Value Life Insurance

Three Types Of Cash Value Life Insurance

Three Types Of Cash Value Life Insurance

Types Of Life Insurance Which Is Right For You Daveramsey Com

Types Of Life Insurance Which Is Right For You Daveramsey Com

Whole Life Insurance How It Works

Life Insurance In Superannuation Tips Traps First Financial

Life Insurance In Superannuation Tips Traps First Financial

The Three Types Of Life Insurance Webinar Recording Tony

The Three Types Of Life Insurance Webinar Recording Tony

Different Types Of Life Insurance Qifa Financial Planners

Different Types Of Life Insurance Qifa Financial Planners

Famers Whole Life Insurance Review Not Your Best Bet

Famers Whole Life Insurance Review Not Your Best Bet

Life Insurance Basic Policy Types Ppt Download

Life Insurance Basic Policy Types Ppt Download

Three Kinds Of Life Insurance And How They Re Mis Sold Bw

Three Kinds Of Life Insurance And How They Re Mis Sold Bw

There Are Three Types Of Life Insurance Policies T Chegg Com

There Are Three Types Of Life Insurance Policies T Chegg Com

Types Of Life Insurance In Pittsburgh

Types Of Life Insurance In Pittsburgh

People Who Don T Need To Buy Life Insurance Retirees Kids

3 Different Types Of Life Insurance Policies Life Insurance

3 Different Types Of Life Insurance Policies Life Insurance

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrvtq Po Svlnkoeibvqxwh Shuyqhdfd9ag0qxx8jk Lph5eyp

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrvtq Po Svlnkoeibvqxwh Shuyqhdfd9ag0qxx8jk Lph5eyp